In the world of handling payroll for small and medium-sized businesses, QuickBooks Desktop Payroll is an essential tool that simplifies various payroll tasks. Keeping your Payroll Tax table current is important for smooth payroll processing. However, technical problems like QuickBooks Error PS038 can sometimes occur, potentially disrupting your payroll activities and online paycheck processing. This guide offers you the key resources and straightforward solutions to effectively address and fix this issue, ensuring your payroll management continues without interruption. With our expert advice, you’ll not only resolve this uncommon yet persistent problem but also enhance the overall performance of your QuickBooks Desktop Payroll, keeping your business’s payroll operations on track.

If you’ve already gone through this article and still haven’t found a solution, we highly recommend contacting our dedicated Data Service Support team at +1-888-538-1314. They are available to provide you with immediate assistance and personalized guidance.

Let’s Fully Understand What QuickBooks Error PS038 Is

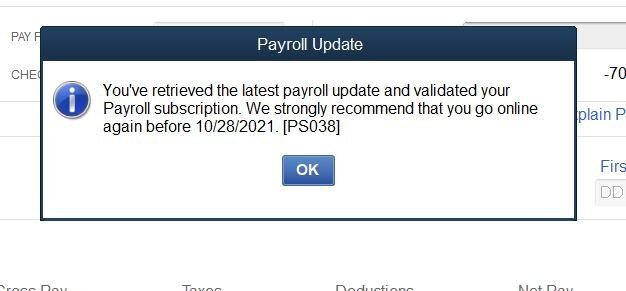

QuickBooks Error PS038 is a known issue that users of QuickBooks may encounter, typically characterized by the alert message: “You have successfully downloaded the latest payroll update patch and verified your payroll subscription. We strongly recommend that you go online again before XX/XX/XXXX [PS038].” This error poses a significant challenge, particularly in disrupting payroll processing activities. It commonly occurs when paychecks are marked as “online to send” or are stuck in the processing queue.

Reasons why QuickBooks Error Code PS038 occurs?

The problem of “Stuck Paychecks in QuickBooks Payroll Update Error PS038″ can create delays in processing salaries, hinder accurate reporting, and even affect business decision-making. This issue can arise due to various reasons and below you will find the most common ones.

- Use of an outdated version of QuickBooks Payroll software can prompt error ps038

- Incorrect or incomplete installation of QuickBooks Payroll software

- Damaged or corrupted company files may also trigger error ps038 QuickBooks

- You may encounter QuickBooks Payroll Error PS038 due to an Incomplete or corrupt QuickBooks installation

- Malicious programs affecting QuickBooks software or system files

- There are Windows registry issues that are preventing QuickBooks from running and updating properly.

- Conflicts with other installed software

- Firewall or antivirus software blocking QuickBooks

- The system clock set to an incorrect time or date

- Improper system shutdown resulting in data corruption

- PS038 QuickBooks Error can be caused by damaged hard drive sectors, that can prevent the software from receiving updates.

- Damaged or corrupt network data file (.ND) or QuickBooks Transaction Log (.TLG) file

- Inadequate system resources such as insufficient memory or low disk space

- Unstable network connection or server issues

- Improper payroll subscription setup or outdated subscription details can also cause QuickBooks to prompt error ps038

Prior Things to Do Before Troubleshooting QuickBooks Error PS038

Before diving into troubleshooting QuickBooks Error PS038, there are critical steps you should take to ensure a smooth and effective resolution process. These preparatory actions are key to successfully addressing the issue:

- Verify QuickBooks Version: It’s vital to check that you’re using an Intuit-supported version of QuickBooks. Compatible versions include QuickBooks 2021, 2022, 2023, and 2024. Using the right version ensures that your software is up-to-date and capable of handling the troubleshooting process efficiently.

- Update Payroll Tax Tables: Make sure your QuickBooks payroll system is equipped with the latest payroll tax tables. This update is crucial as it ensures that your payroll calculations and processing are accurate and compliant with the latest tax laws.

- Limit Rebuild Data Usage: Avoid running the Rebuild Data function more than a couple of times. Excessive use of this feature can lead to complications in your data file, making the troubleshooting process more complex.

- Operate in Single User Mode: Ensure that you are using your QuickBooks in Single User Mode when attempting to troubleshoot. This mode provides a more controlled environment, reducing the risk of conflicting operations that might occur in Multi-User Mode and ensuring a more focused and effective troubleshooting process.

By following these essential steps, you’ll set a strong foundation for effectively tackling QuickBooks Error PS038, enhancing your chances of a quick and successful resolution.

We excitedly shared news about the announcement of QuickBooks Desktop 2024. This latest version promises to bring a host of new features and improvements, tailored to enhance the accounting experience for small and medium-sized businesses. QuickBooks has always been at the forefront of financial management solutions, and with this new release, they continue their commitment to innovation and user-friendly design. Read More

Stepwise guide to fix Payroll Update Error PS038 QuickBooks Desktop

If you’re interested in finding out which method provides a 100% guarantee to resolve QuickBooks Error PS038, Well, We will advise you to carry out the steps in the order mentioned below by our experts.

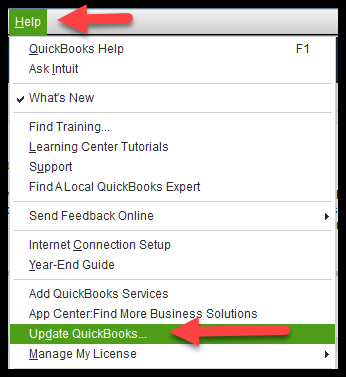

1st Step: Update QuickBooks Desktop and backup your data

To Update QuickBooks Desktop software check out the following video and then go through the manual steps given underneath:

To Manually Update QuickBooks:

- Open QuickBooks Desktop App as a Windows Admin user.

- Tap on the [Help menu] option, thereafter select, [Update QuickBooks Desktop].

- Next, choose the [Update Now] option, and then Select For [Get QuickBooks Update] option.

- Wait While the Update is downloading.

- Reopen the QuickBooks Desktop and grant permission to install the recently downloaded update.

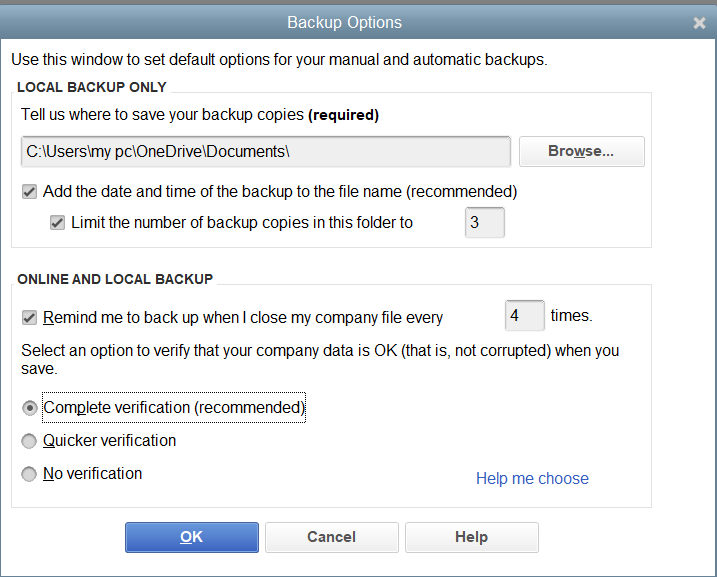

To Back up your Company File Data:

- Turn your QuickBooks into [single user mode].

- Next, Click on the [File menu], and then drag your mouse over the [Backup Your Data File] option, and then choose the [Create Local Backup] Option.

- In the Local Backup option, Click on the browse option and then select the suitable directory to save the backup file.

- Next, In the [Online and Local backup] options to Run a Test to analyze the data.

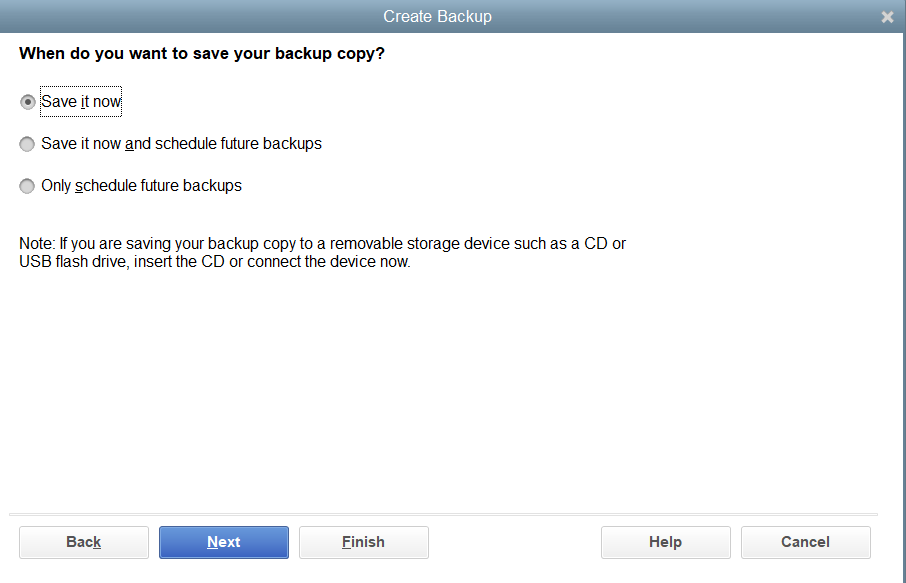

- At Last, select option [Save it now].

Note: You can also choose either one [Save it now Schedule future backups] or [Only Schedule for future backups].

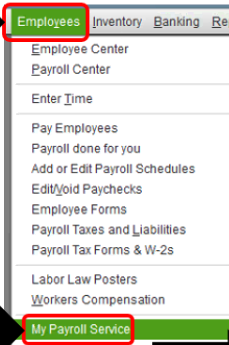

2nd Step: Send Usage data or Payroll data

- Launch the QuickBooks Payroll.

- Later, Click on the [Employees] option and then choose [My Payroll Service].

- In My Payroll Service, Select For the [Send payroll usage data].

Note: In Some QuickBooks Desktop version user may find send payroll Data option under the Employees option.

- Later try to send payroll data, If data is sent successfully, then go back to update QuickBooks Payroll.

- In case of error persists, then you should reach out to experts at +1-888-538-1314 and Let experts help you.

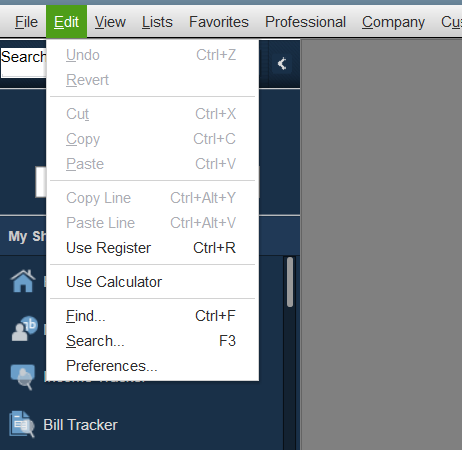

3rd Step: Find out the checks stuck in the middle

- Click on the [Edit] button and then drag your mouse cursor to select the [Find] option.

- Later in the Find option, Select the [Advanced tab] Option.

- In the Advanced tab, Click on the [Filter] Option.

- Choose the [Detail Level Filter] Option from the List of Filters.

- Subsequently, Choose [Summary only].

- Go back to the list of Filters and pick [online status] Filter.

- Next, Select [Online to send] Filter.

- At last, Press the [Ctrl + F] button or choose the Find option to Locate unsent paychecks.

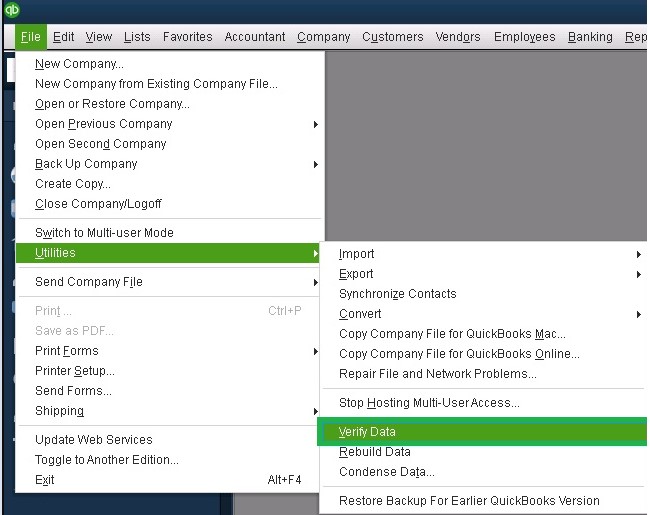

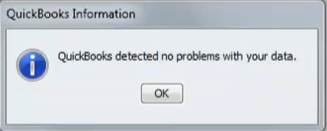

4th Step: Perform Verify and rebuild Data utility Test

To effectively tackle QuickBooks Payroll Error PS038, a structured approach using the Verify and Rebuild Utility can be very helpful. Here are the steps simplified:

- Open QuickBooks and head to the ‘File‘ menu. Here, choose ‘Utilities‘ and then ‘Verify Data‘.

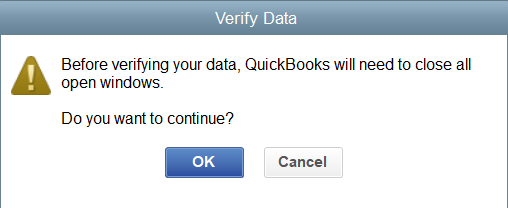

- You’ll see a popup asking, ‘Do you want to continue?’. Click ‘OK‘.

- The Verify Data tool will start scanning your file. If it finds errors, a notification will pop up indicating there are issues.

- If it doesn’t find any, you don’t need to use the Rebuild Data tool.

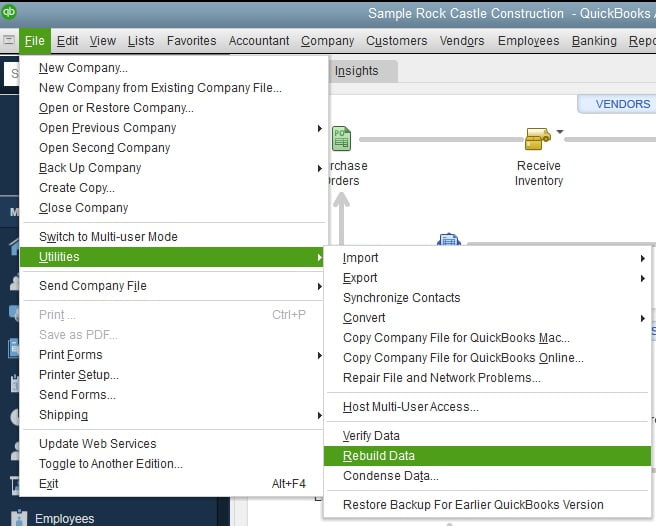

Note: Performing the “Rebuild” tool in QuickBooks more than twice on the same company file is not advisable. Doing so can result in data loss or corruption and may not fix the underlying issue causing the need for the rebuild. If you encounter persistent issues even after performing two rebuilds, it’s best to seek assistance from a QuickBooks Data Recovery team.

- In case of detected errors, go back to ‘Utilities‘ and choose ‘Rebuild Data‘. You will be prompted to back up your company file.

- You’ll have the option to choose between an online backup or a local backup. Pick the one that best fits your needs.

- Decide how often you want to back up your data – daily, weekly, or monthly.

- You’ll then be asked, ‘Do you want to save the backup now or schedule it for later?’ Choose as per your preference and click ‘Next‘.

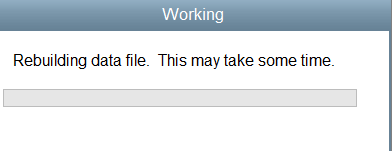

- Start the Rebuild Data utility, and a window will display its progress.

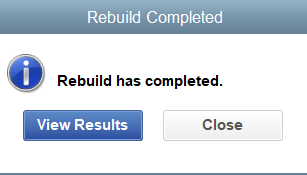

- Once the Rebuild Data process finishes, it’s wise to run the Verify Data tool again to ensure all issues are thoroughly resolved.

- Review the final report for any lingering errors and note them down.

- If the report still shows unresolved issues, consider repeating the process or seeking additional help.

If the “QuickBooks Verify and Rebuild Data” process does not detect a stuck paycheck, it could suggest that the company file, along with the transaction for the stuck paycheck, has been condensed. This situation might also contribute to QuickBooks Error PS038, which hinders the updating of QuickBooks. In such cases, our next recommendation is to proceed with a more thorough and detailed inspection of any unsent or stuck paychecks.

Read More:- Stepwise Fix QuickBooks Desktop won’t update issue

5th Step: Detailed Inspection of unsent paychecks

To avoid any errors or discrepancies in employee pay, it is essential to remove unsent paychecks from QuickBooks. However, before deleting unsent paychecks, it’s important to ensure that they are not included in a scheduled payroll run or tax forms. This helps to prevent any problems with employee pay and tax calculations.

To remove unsent paychecks from QuickBooks, follow the steps listed below:

- Firstly, Follow the 3rd step to get a sorted list of unsent paychecks.

- Later, select the very first-time stuck paychecks and then pick [detail paychecks].

- The moment’s [review paychecks] window will appear.

- Add a new item, the same as the final earning item, under the earnings item list.

- Adding a new item to the earning list will pop up a prompt [Net Pay Locked]. You need to select the [No] option to close.

- Ensure, You didn’t make any modifications in [Net Pay] and [tax amounts], and then select [ok].

- Select [Yes], When you see the [Past Transaction] prompt.

- Next, Click on the [Save & Close] button to close the [detail paycheks] window.

- Click on [Yes], When the [Saving transaction] prompt appears.

- Open the same paychecks again.

- Deleted the newly added item from the earning item list.

- Repeat the above steps for each [unsent/stuck paycheks].

- When you have done the above step for each check, then you should first update your QuickBooks.

If the issue persists, I would recommend trying step 6, which involves using the QuickBooks Auto Data Recovery tool.

6th Step: Use QuickBooks ADR(Auto Data Recovery)

To resolve QuickBooks Error PS038 and get back to running payroll with confidence, you can utilize the QuickBooks Auto Data Recovery tool by following a few simple steps. For detailed instructions and guidance on using this tool, we recommend referring to the QuickBooks Data Service Team. With the help of this tool and Data Service expert guidance, you can quickly and easily recover your data and avoid potential data loss, ensuring that your payroll and accounting processes run smoothly and efficiently.

7th Step: Employ Backup for Payroll Data and Company Files

A QuickBooks PS038 Desktop error may sometimes impede access to payroll data or company files. In such cases, leveraging a backup can facilitate uninterrupted operations:

- Navigate to the ‘File’ tab within the QuickBooks software.

- Opt for the ‘Backup Company’ option, then select the ‘Create Local Backup’ choice.

- Upon reaching the backup creation page, select ‘Local Backup’.

- Next, move to the ‘Options’ tab, which will prompt a ‘Backup Options’ window to appear.

- Click on ‘Browse’ at this stage to designate the destination for the file backup.

- Once a location is chosen, click ‘OK’ to validate your selection.

- It’s recommended to initially save the backup on the local drive. Subsequently, you can choose a file hosting service, flash drive, or other portable storage media.

- Upon completion of these steps, verify whether the QuickBooks PS038 error still persists.

Read More – How to resolve QuickBooks Payroll Subscription Error PS036

8th Step: Utilize QuickBooks Tool Hub to Execute “Quick Fix My Program”

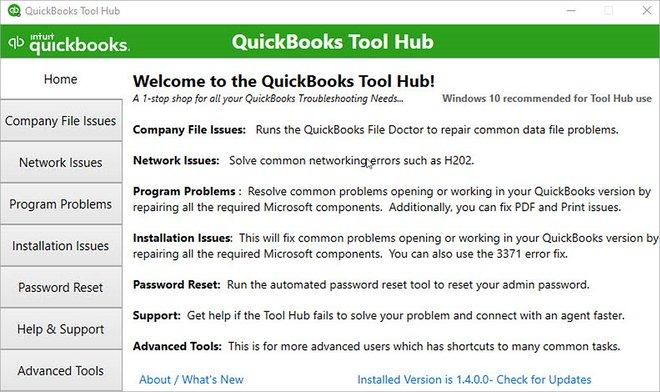

The QuickBooks Tool Hub is a versatile application that provides solutions for common errors within QuickBooks. To make the most of this tool, it is recommended that you operate it on Windows 10, 64-bit. Here are the steps to execute the “Quick Fix My Program” utility.

Step 1: Get the QuickBooks Tool Hub Ready

You’ll need to close QuickBooks first in order to use the QuickBooks Tool Hub.

- Download the latest version of the QuickBooks Tool Hub. Be sure to save the file in a location that’s easy to find, such as your Downloads folder or the desktop of your Windows PC. Note: If you have previously installed the Tool Hub, you can find the version you have by selecting the Home tab. The version information will be displayed at the bottom.

- Open the downloaded file (QuickBooksToolHub.exe) and follow the on-screen instructions to install the program, making sure to agree to the terms and conditions.

- Once the installation is complete, double-click the QuickBooks Tool Hub icon on your Windows desktop to open the application.

Note: If you are unable to locate the icon, use the search function in Windows, type “QuickBooks Tool Hub” and select the application.

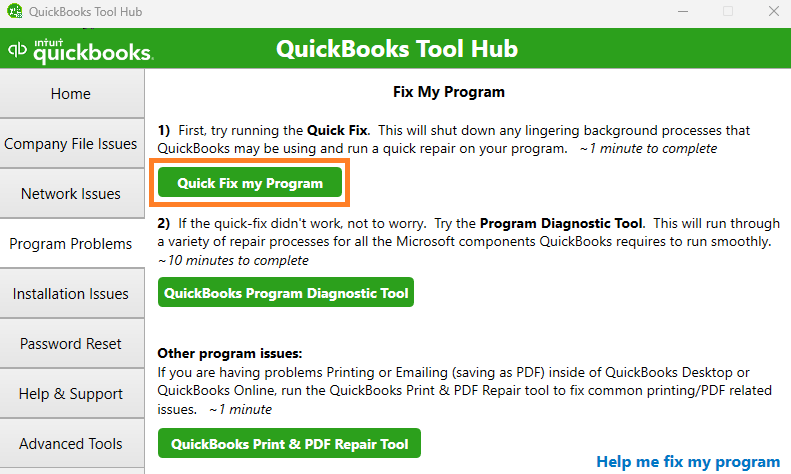

Step 2: Run the “Quick Fix My Program” Utility

The Quick Fix function will close any background processes that QuickBooks might be running and perform a rapid repair of your software.

- In the QuickBooks Tool Hub, select the “Program Problems” option.

- Next, select the “Quick Fix my Program” option.

- Once the Quick Fix is complete, start QuickBooks Desktop and open your data file.

Through these steps, you should be able to address QuickBooks Error PS038. Remember, the QuickBooks Tool Hub is a great resource to help solve common problems with the software.

Additional Troubleshooting Steps For QuickBooks PS038 Error

In this section, we have provided additional solutions for QuickBooks Error PS038, which may assist you in getting your Payroll back on track.

Additional Method 1: Configure Windows Firewall to Recognize QuickBooks as an Exception

A common cause of QuickBooks application malfunctions can be the Windows Firewall. The firewall might perceive QuickBooks as a potential risk and protect the system by inhibiting its operation. If that’s the case, the solution is to designate QuickBooks as an exception, allowing it to access the internet and function seamlessly:

- Click the Windows icon on your keyboard to bring up the Start menu.

- In the search field, input ‘Windows Firewall‘ and hit Enter.

- When the Windows Firewall window appears, select ‘Advanced Settings.’

- Next, pick ‘Inbound Rules,’ followed by ‘New Rule.’

- Choose the ‘Port‘ option and click ‘Next.’

- Ensure to select ‘TCP,’ then key in the specific ports required for your QuickBooks version.

- Enter the relevant ports in the ‘Specific Local Ports’ field based on your QuickBooks year version:

- For QuickBooks Desktop 2022 and later: 8019, XXXXX.

- For QuickBooks Desktop 2021: 8019, XXXXX.

- For QuickBooks Desktop 2020: 8019, 56728, 55378-55382.

- For QuickBooks Desktop 2019: 8019, 56727, 55373-55377.

- Click ‘Next‘ after entering the port number.

- Choose ‘Allow the Connection‘ and hit ‘Next.’

- If prompted, check all profiles.

- Name the rule in this format- “QBPorts(year)” for straightforward identification.

- Hit ‘Finish’ when complete.

Repeat these steps for ‘Outbound Rules‘ and check if the QuickBooks Desktop error still exists. Subsequently, create a Windows Firewall exception for each QuickBooks program and executable file (.exe) by following the above steps.

Here’s the list of .exe files and their paths:

| .exe File | Path |

|---|---|

| Dbmlsync.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBW32.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| DBManagerExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| AutoBackupExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| FileManagement.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QuickBooksMessaging.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBServerUtilityMgr.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBDBMgrN.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| QBLaunch.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| QBCFMonitorService.exe | C:\Program Files\Common Files\Intuit\QuickBooks |

| FileMovementExe.exe | C:\Program Files\Intuit\QUICKBOOKS YEAR |

| IntuitSyncManager.exe | C:\Program Files\Common Files\Intuit\Sync |

| QBUpdate.exe | C:\Program Files\Common Files\Intuit\QuickBooks\QBUpdate |

| OnlineBackup.exe | C:\Program Files\QuickBooks Online Backup |

With these steps, QuickBooks error PS038 should be successfully resolved.

Bottom-Line

The steps we’ve shared above aim to fix stalled paychecks and remove the QuickBooks Error PS038. This article thoroughly explores the possible causes of this error and offers detailed solutions. However, if you’re still facing this issue and need extra help from experts, don’t hesitate to call our QuickBooks Data Recovery Services Helpline at +1-888-538-1314. Our team is always ready to make your QuickBooks experience smoother and more manageable.

Frequently Asked Questions on QuickBooks PS038

Is it necessary to update QuickBooks payroll tax tables?

Yes, it is crucial to update your payroll tax tables regularly. If you’re using QuickBooks Online, updates happen automatically, so you won’t need to manually update. However, if you’re using QuickBooks Desktop, you’ll either need to update manually or ensure automatic updates are enabled.

What can be done to avoid Error PS038 in QuickBooks Desktop?

To prevent Error PS038 in QuickBooks Desktop, follow these steps:

Step 1: Keep your QuickBooks and Payroll up to date.

Step 2: Always ensure you properly close your QuickBooks Company File after finishing your work.

Can a stuck paycheck in QuickBooks Desktop Error lead to duplicate entries?

Yes, trying to re-enter a paycheck that appears to be stuck can create duplicate entries. It’s wise to diagnose the underlying problem first to avoid complicating the issue further.

Are there any specific settings I should look into if paychecks are getting stuck regularly?

Regular paycheck issues may be linked to incorrect settings within your payroll setup. Thoroughly reviewing the configuration and making necessary adjustments can help prevent this problem.

What causes paychecks to get stuck in QuickBooks Desktop?

It might be due to several factors like corrupted data files, improper settings, or even network issues. Understanding the root cause is essential to fix the problem.

Hi, I am using QuickBooks Desktop Pro 2023, and I have checked solutions across the entire internet, but none have worked. Please help me understand what to do to resolve QuickBooks Error PS038.

Hello,

I understand that you’re facing QuickBooks Error PS038 and have been unable to find a solution on the internet. This issue can be complex, and addressing it might require a detailed review of your specific situation.

Please reach out to us at QuickBooks Data Services by calling +1-888-538-1314 to get assistance instantly. Our team of experts is standing by to help you resolve this error quickly and efficiently.

I look forward to assisting you soon!

Best regards,

James

QuickBooks Data Services Expert

Hello Community,

I’ve recently upgraded to QuickBooks Desktop 2024, but I’m running into Error PS038 when trying to complete payroll updates. It’s quite worrisome as payroll is due soon. Has anyone else experienced this or can offer a solution?