Fixing beginning balance issues while reconciling in QuickBooks Desktop can be challenging, yet it’s crucial for maintaining accurate accounting records. These discrepancies, often referred to as QuickBooks beginning balance discrepancies, can arise from various causes such as prior adjustments, data entry errors, or software updates. This article provides a detailed walkthrough to help you identify and resolve QuickBooks balance issues, ensuring your financial statements are consistent and reliable. Whether you’re a seasoned accountant or a new QuickBooks user, our guidance will simplify the process of correcting beginning balance in QuickBooks, helping you overcome common QuickBooks reconciliation discrepancies and QuickBooks balance sheet errors effectively.

If you’ve followed the steps to fix beginning balance issues while reconciling in QuickBooks Desktop but still encounter discrepancies, it’s important to seek expert help. For persistent QuickBooks Desktop reconciliation problems, please contact the QuickBooks Data Service team at +1-888-538-1314 for specialized assistance.

Common Reasons for Beginning Balance Issues in QuickBooks Desktop

Encountering beginning balance issues during account reconciliation in QuickBooks Desktop can significantly impact the accuracy of your financial reports. Identifying the root causes is crucial for effective resolution. Here are some common factors that lead to these discrepancies:

- Previous Reconciliations Adjusted: Any changes or deletions in previously reconciled transactions can alter the beginning balance.

- Data Entry Errors: Mistakes made during the data entry process, such as incorrect transaction dates or amounts, can lead to discrepancies.

- Improperly Linked Transactions: Transactions that are not correctly linked (e.g., payments not appropriately matched with invoices) can affect the balance.

- Software Updates: Occasionally, updates to QuickBooks Desktop might result in unexpected changes to data files, impacting balances.

- Corrupted Data Files: Corruption within the QuickBooks data file can cause numerous issues, including incorrect beginning balances.

- Deleted Transactions: If previously entered and reconciled transactions are deleted, this will also impact the reported beginning balance.

By carefully examining these potential issues, users can better understand the steps needed to correct their beginning balance discrepancies and ensure their financial records are accurate and reliable.

Solutions to Fix QuickBooks beginning balance discrepancies

Resolving these discrepancies is crucial for maintaining accurate financial records. Below, we explore a series of solutions that can help rectify these balance issues, ensuring your accounting data remains precise and reliable.

Solution 1: Verify and Rebuild Data

Resolving beginning balance issues in QuickBooks Desktop can often be achieved effectively using the Verify and Rebuild Data utilities. These tools help identify and fix data integrity issues that may be causing discrepancies. Follow this streamlined process to use these utilities:

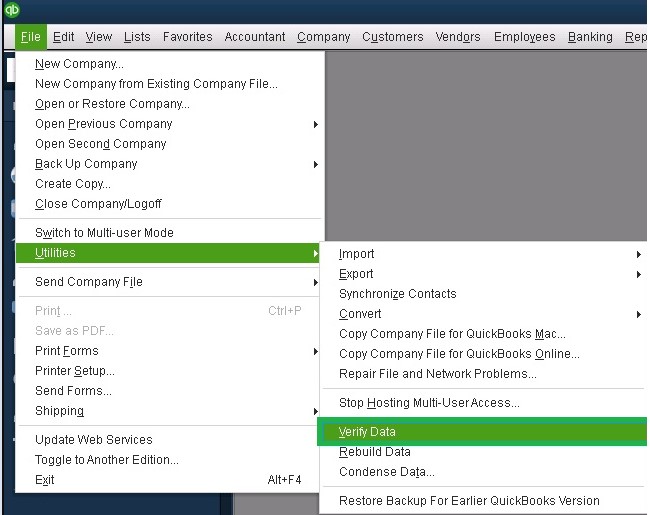

Using the Verify Data Tool:

- Launch QuickBooks Desktop.

- Go to the ‘File’ menu, select ‘Utilities’, and then choose ‘Verify Data’.

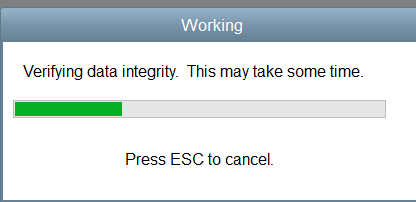

- Click ‘OK’ on the popup to start the verification process.

- If the tool finds errors, a notification will indicate issues need resolving. If no issues are found, there’s no need for further action with the Rebuild Data tool.

Using the Rebuild Data Tool:

- If errors are detected by the Verify Data tool, return to the ‘File’ menu.

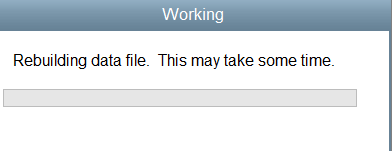

- Select ‘Utilities’ and then ‘Rebuild Data’.

- You will be prompted to back up your company file. Opt for either an online backup or a local backup based on your needs. Set your backup frequency (daily, weekly, or monthly) and decide if you want to save the backup immediately or schedule it for later.

- Begin the Rebuild Data process. A progress window will show the status of the rebuild.

Note: It is advisable not to perform the “Rebuild” tool in QuickBooks more than twice on the same company file to avoid potential data loss or corruption. If persistent problems remain after two rebuild attempts, professional help may be necessary. For expert assistance, contact the QuickBooks Data Recovery team at +1-888-538-1314.

By following these steps, you can ensure the accuracy and integrity of your financial data in QuickBooks Desktop.

Solution 2: Check for Data Entry Errors

Accidental misentries such as incorrect amounts, dates, or transaction details can lead to significant issues in your financial reports. Diligently reviewing your entries is crucial to ensuring the accuracy of your reconciliations. Here’s how you can effectively check and correct data entry errors:

- Review Recent Transactions:

- Go through the transactions recorded since your last successful reconciliation. Pay special attention to the amounts and transaction dates.

- Ensure that each transaction is posted to the correct account and that duplicates are removed.

- Double-Check Opening Balances:

- Verify that the opening balances for the period being reconciled are accurate. Errors in these balances can propagate throughout your financial records.

- Compare the QuickBooks balance against your monthly bank statements to ensure they match.

- Audit Trail Report:

- Utilize the Audit Trail feature in QuickBooks to help identify any changes or deletions made to transactions. This report can be particularly helpful in spotting unauthorized or accidental modifications.

- To access the Audit Trail, go to the ‘Reports’ menu, select ‘Accountants & Taxes’, and then click on ‘Audit Trail’.

- Use Reconciliation Discrepancy Report:

- This report shows transactions sorted by statement date that were changed since the last reconciliation. It can help isolate specific entries that may have caused the balance issues.

- To generate this report, go to the ‘Reports’ menu, choose ‘Banking’, and then select ‘Reconciliation Discrepancy’.

- Engage with Collaborators:

- If multiple people have access to the financial records, discuss any discrepancies with them. Sometimes, errors arise from miscommunication or misunderstanding of the accounting processes.

By methodically checking for and correcting data entry errors, you can significantly reduce the occurrence of balance discrepancies in QuickBooks Desktop. This process not only ensures the integrity of your financial data but also maintains the overall health of your accounting system.

Reaching a Stopping Point

As we conclude this section, we’ve provided foundational solutions to help resolve beginning balance issues in QuickBooks Desktop. If implementing these strategies hasn’t fully resolved your discrepancies, it may be time to explore additional solutions. For personalized assistance and more advanced troubleshooting, don’t hesitate to contact the QuickBooks Data Service at +1-888-538-1314. Their expert support can guide you through more complex issues to ensure your financial records are accurate and up-to-date. Stay tuned for further solutions and tips in the next sections of our guide.